Take the first step

towards home ownership

Our experienced team can help you find your next home. We also offer assistance with financing and government subsidies.

Current Offers

DEVELOPMENTS

GREENWOOD GARDENS

Benoni

From R515 000 apartments

R779 000 homes

EAST VIEW

Brakpan

From R805 500

SELCOURT

Pretoria

From R699 000

REIGER PARK

Boksburg

PRESIDENT PLACE

Midrand

From R1 359 000

TIRONG

Kya Sands

SKY CITY

Alberton

From R779 200

THE BRONX

Alberton

From R654 000

MILANO

Alberton

From R991 300

STAR VILLAGE

Soweto

From R789 300

Our Work In Numbers

WE HELP YOU TO

GET YOUR DREAM HOME!

Green Eye Housing boasts an impressive portfolio of developments. No matter your budget, we can help you get closer to owning your next home. Contact our team of agents today to get bespoke recommendations for properties that match your needs.

Occupants of all homes sold by Green Eye Housing.

View Our Portfolio

CHECK OUT OUR WIDE RANGE OF DEVELOPMENTS

Our website is always up-to-date with the latest developments on offer by Green Eye Housing. Browse our wide range now and contact us if you’d like to start the journey towards homeownership.

OUR AREAS

We are proud to offer developments in a range of suburbs in Gauteng. See an overview of our most popular areas below.

- Johannesburg

- East Rand

- Pretoria

- Midrand

Need Some Help?

WE OFFER ASSISTANCE WITH FINANCING

Don’t let the world of homeloan financing overwhelm you. Our team can help you to submit a home loan application to all major banks to find the best deal for you.

Navigating Property Taxes and Financial Essentials for South African Homeowners

Navigating the Homebuying Process: A Guide for First-Time Buyers

Home is Where the Heart Is: Tips for Turning Your House into a Home

Choosing Between an Apartment, Townhouse, or Free Standing House: Finding Your Ideal Home

Unlocking Your Dream Home: Practical Financial Tips for 2024

Home Insurance Explained: Protecting Your Investment and Peace of Mind

The Team

MEET THE AGENTS FROM GREEN EYE HOUSING

Gert van der Mescht

Marketing Manager

- 083 616 0077

- gertm@gsdevelopments.co.za

Tshepiso Sedibe

Sales Consultant

- 064 511 7810

- tshepiso@gehousing.co.za

Beki Sibanda

Sales Consultant

- 061 466 1667

- beki@gehousing.co.za

What People Say

Customer Reviews

Lungile Shezi

"The best and the service is amazing I'm very happy with Green Eye Housing got to own my 1st home with their help."

Simosenkosi Precious

"The service has been great so far, I am going to be a first time home owner and Beki has been so patient, kind, friendly and has been assisting me the best way possible togetherwithMzwakhe. I have been kept informed every step of the way. I am really excited about this journey."

REACH OUT TODAY

Need some help? Fill in the below form and one of our agents will get back to you in no time.

Frequently Asked Questions

GET THE ANSWERS YOU ARE LOOKING FOR

Buying a house will usually require you to put down a deposit of 10% — 20% of the purchase price upfront.

However, there is the option of acquiring a 100% home loan, which will remove the need to pay a deposit as the loan is funded entirely through monthly repayments.

You can determine what home loan you’re likely to qualify for, and what your monthly repayments will be, using our Bond Calculator. This will help you plan your budget, factoring in the cost of the deposit.

Being pre-approved doesn’t mean you’re approved. It means you have an idea of what you would likely qualify for.

The pre-approval process takes into account your credit score and determines the size of the home loan you would qualify for.

It does, however, provide proof you can afford the amount for which you’ve prequalified. This proof can be useful when dealing with the property seller.

It also helps with your house hunt, as you know the price bracket you should be looking at if you want to improve your chance of home loan approval.

You can get pre-approved by contacting Green Eye Housing or by using our free, online prequalification tool, the Bond Indicator.

If you are unable to pay off debts, your name will be flagged by the credit bureau, and added to a blacklist; and it will be more difficult for you to get loans in the future.

The simplest way to clear your name from the credit bureau is to pay off the debt. According to TransUnion, one of South Africa’ biggest credit bureaus, this will usually result in your name being removed from the blacklist within 7 – 20 days.

You can also request that your creditor write to the credit bureau to notify them that the debt has been paid, and that they can remove your name from the list, although your creditor is not obligated to do this.

If you are struggling to pay off debts, you should consider going into debt counselling.

If you are concerned about the prospect of being blacklisted, you can check your credit record to see what your standing is. We can provide you with your credit score if you apply for home loan prequalification, either by using our free, online tool, the Bond Indicator, or by contacting us at Green Eye Housing.

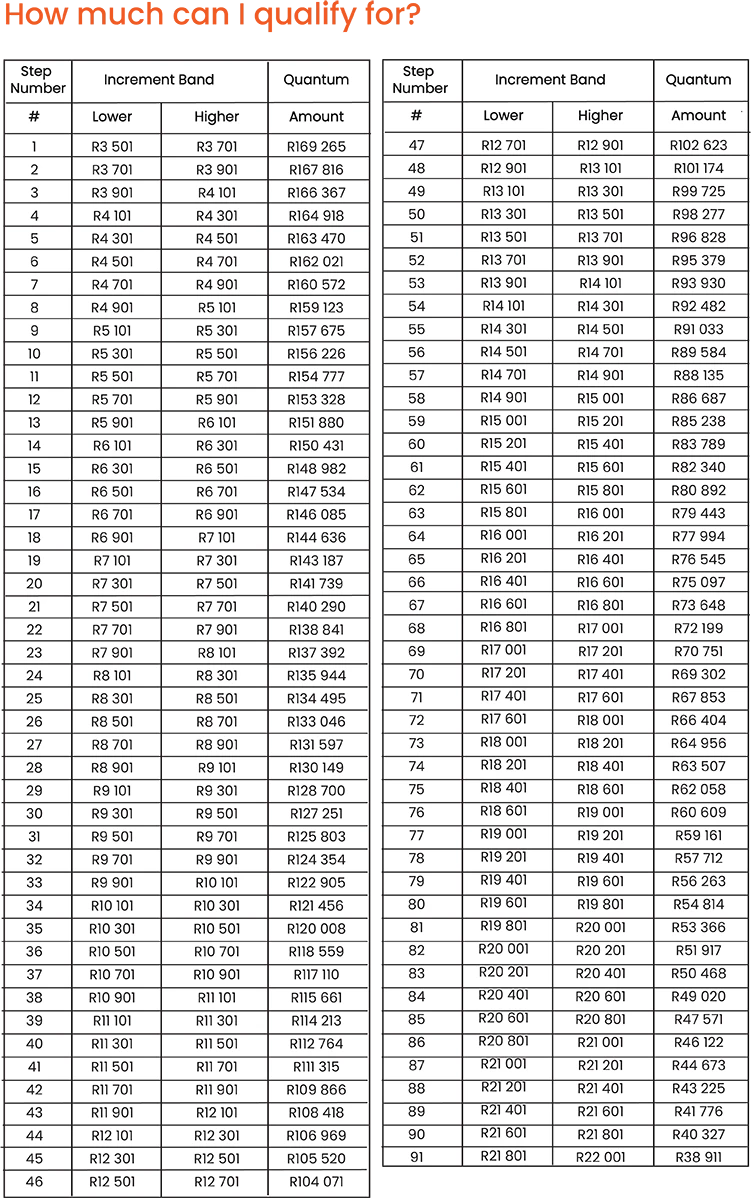

To qualify for FLISP, you must have an income of R3501—R22 000 per month. Then, the lower your income within that bracket, the higher your subsidy.

For low and middle-income earners, FLISP provides a government subsidy for your home loan. The size of the subsidy depends on your income.

Your income must be in the R3 501 to R22 000 per month bracket to qualify for FLISP.

Then, the lower your income within that bracket, the higher your subsidy.

The subsidy ranges from R30 001 to R130 000.

For a more detailed look at subsidies, you may peruse the table below:

You can apply for a bond with anyone you choose: a partner, (even if you’re not married), a friend, or with one or multiple family members. Just make sure you have a legal agreement drawn up between the parties in question to protect all of your interests.

What do the banks look at when considering my home loan application?

The first thing the banks will do is review your credit score. Then they will look at your income and expenses to gauge your ability to repay the monthly home loan instalments. They will also take the size of your deposit (if you have one) into account.